KrASIA’s Morning Briefing is a closed-door presentation that delves into a different industry every 1st and 3rd Tuesday of the month. Register here for the next episode on consumer brands (sportswear) in China, 4 May, 9 – 9.30am (GMT +8); the case study will be on the Chinese sports brand that is taking on Nike and Adidas.

Episode 5 of Morning Briefing showcased a different part of China’s New Economy — FMCG, specifically household care brands. In this episode the team dove into the size and what influences industry development, highlighting a few key episodes that demarcated consumers changing preferences and demands. In the case study segment, Blue Moon, one of China’s earliest domestic brands, was discussed. The team examined how its opportunistic positioning and winning strategies had led it to be the top brand for laundry detergent. Its future challenges were also deliberated on.

The fastest growing market in the world

With a booming middle-class population—from 3.1% in 2000, to 50.8% in 2018— and GDP per capita recorded at USD 10,216 in 2019, living standards in China are improving. Coupled with China’s flourishing convenience economy, consumers are demanding access to more effective, high-quality products. This includes daily products like those for household care.

China’s household care has indeed flourished in recent years. In the period of 2015 – 2019 the compound annual growth rate (CAGR) of the entire industry hit 5.3%, the highest in comparison to other major global markets like the US and Europe. Reaching a value of 16.79 billion US dollars, or 110 billion yuan, as of 2019.

With more disposable income, consumers also have more purchasing power. Urban consumers, in particular, live fast-paced modern lifestyles and demand more convenient, effective cleaning products to suit such lifestyles. Naturally, opportunities arise with these shifts in consumer preferences for more sophisticated products.

There have also been a few note-worthy episodes that have contributed to the household care industry’s development. This includes the SARS outbreak in 2002, which placed liquid hand soap into the consumers consciousness at a time where communal bar soap in public places was considered mainstream in China.

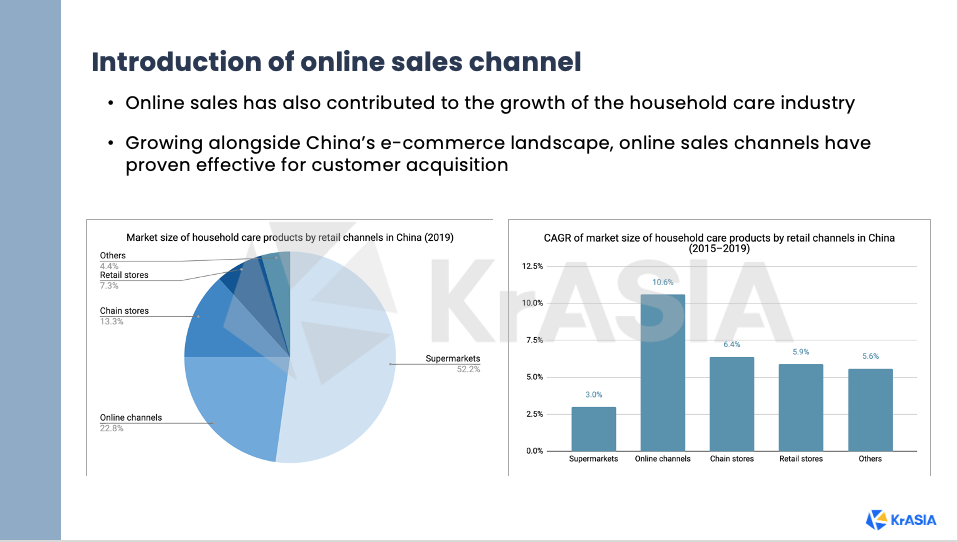

Additionally, the introduction and rapid development of online sales channels in the past decade is also a factor for growth.Given that China’s e-commerce landscape is among the most developed in the world, its not a surprise that it has become an effective channel for customer acquisition. Online sales accounted for 22.8% of household care product sales in 2019. With that said, offline sales still counts for more than 50% of the volume.

Case Study: Blue Moon

Founded in 1992, Blue Moon made its debut at a time when China opened up to foreign brands, and products made by P&G, Unilever, Henkel and Kao were stocked on store shelves. The laundry segment is where the company stands out in both financial and brand power, holding about one-quarter of market share. In December 2020, Blue Moon was successfully listed on Hong Kong Stock Exchange, debuting at 13.16 HKD per share.

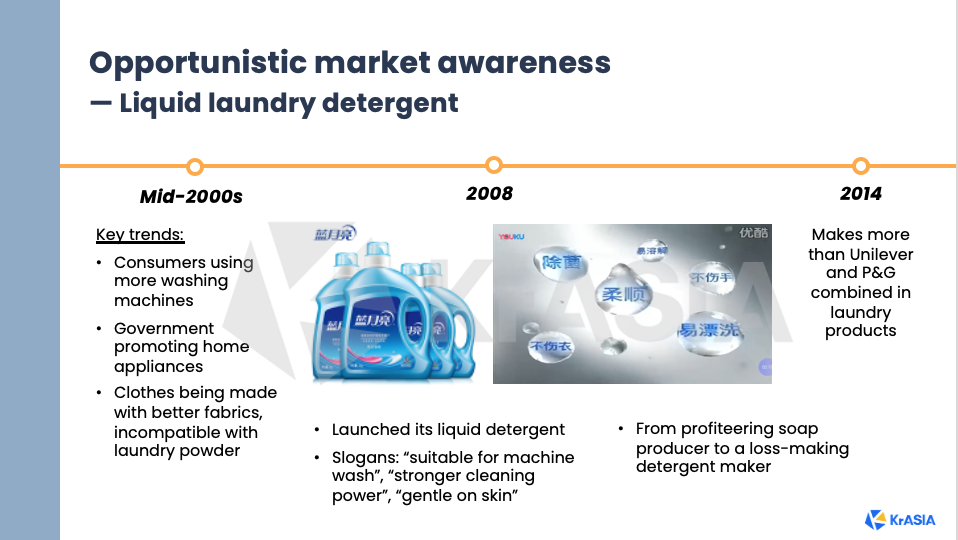

The team discussed factors that moved the needle for Blue Moon. First, the company had opportunistic market awareness and was able to turn external circumstances to their favour. For example, Blue Moon noticed how consumers were beginning to wean off laundry powder in the mid-200s and launched its flagship laundry detergent in 2008.

Blue Moon’s decision turned it from a profit-making soap producer into a loss-making laundry detergent maker. But the strategic losses in 2008 eventually paid off as consumers’ living standards continued to improve. Since 2014, Blue Moon makes more money from its flagship product than Unilever and P&G’s revenues combined (within that same category).

The second factor for success was the company’s close relationship with investor Hillhouse Capital. With advice from Zhang Lei, Hillhouse’s CEO, Blue Moon came to recognise the over-saturation of the powder detergent segment, with more than 10 competing brands — it made more sense in the long run to introduce a new product that fits consumers’ changing demands.

The use of omni-channel marketing also contributed to the company’s success. This includes high-profile sponsorships, large scale events and picking the right brand ambassador at the opportune moment.

For example, Blue Moon leveraged on the hype surrounding the 2008 Beijing Olympics and engaged Guo Jingjing, the diving gold-medalist, to be its brand ambassador. Given that Guo Jingjing was in the public spotlight in 2008, her endorsement came at a high price (RMB 200 million), costing the company’s half its annual revenue that year. Nonetheless, the strategy paid off. Keeping in mind that they introduced their first liquid detergent in 2008, this gave them the star power needed to make a splash. Blue Moon hit 32% market share in 2009, and saw a 27.2% YoY in 2010. Other brands such as P&G’s OMO and Unilever’s Bi Lang did bring onboard celebrity endorsements, however, what made Blue Moon standout was appealing to the Chinese public’s strong sense of national pride.

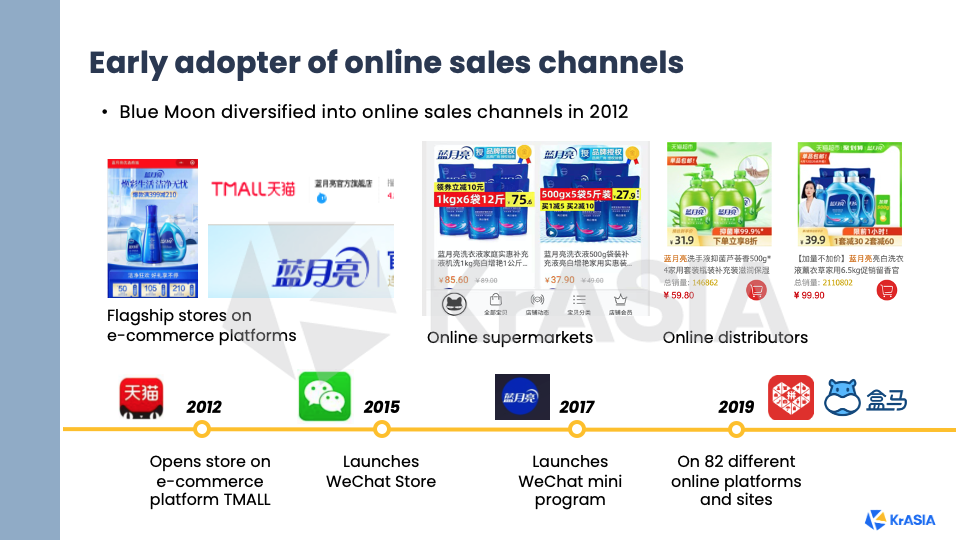

Being an early adopter of online sales channel was also instrumental in the company’s quick acquisition of new customers.

What’s next for Blue Moon?

Despite its successes, Blue Moon has faced its fair share of challenges. First, the company lost out in offline sales in the mid 2010s. This was due to a disagreement in purchasing contract with RT-Mart, one of China’s largest supermarket chains.

Rising shelving fees and overheads such as costs for shop promoters, led to shrinking gross profits. All in all, it is estimated that placing a bottle of detergent in a tier-1, tier-2 city supermarkets, amounted to 30 – 35% of each bottle’s cost. Blue Moon then initiated a change in the pricing and wanted RT-mart to provide them with their own standalone counter. Both parties were unable to come to a consensus, ultimately resulting in Blue Moon withdrawing their products from RT-Mart in 2015.

This event triggered Blue Moon to radically change its focus to developing online sales channels instead. The company subsequently withdrew its products from other supermarket chains such as Carrefour and Walmart.

However, accepting that offline channels still play a crucial part in making sales, Blue Moon subsequently returned to the supermarket shelves in 2017.

Despite that, Blue Moon is unable to regain its lead in offline channels. The 2 year hiatus allowed competitors to fill in the gaps making it difficult for the brand to carve out the same kind of shelf space it once occupied. Not to mention shelving costs are still high. Beyond that, what’s more difficult about this process is that Blue Moon has to rebuild the relationships it once had with the supermarket chains.

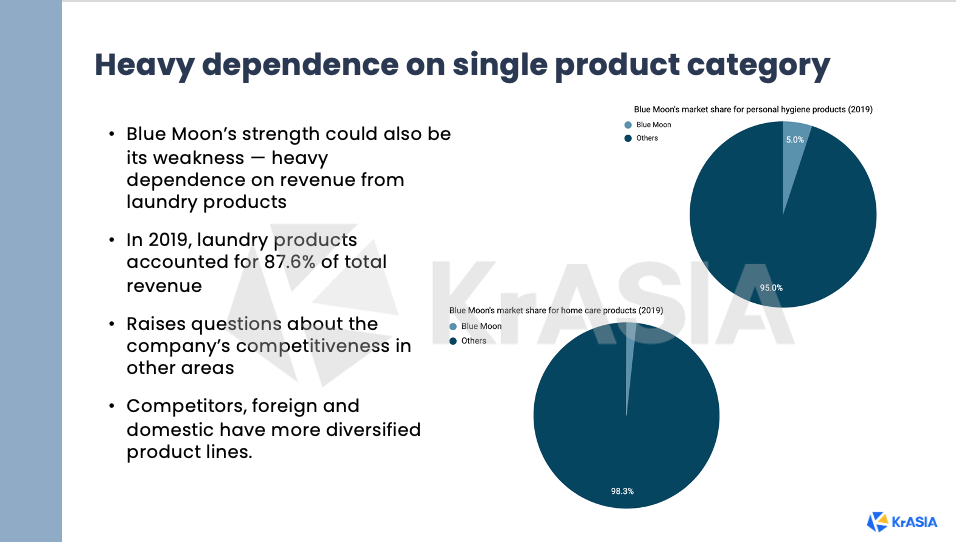

Other important challenges include large scale lay-offs that affected the brand’s image online and heavy reliance on a single product category i.e. its laundry detergent.

In the recent months, Blue Moon’s stock price has taken a tumble. Perhaps reflecting market uncertainties in how the company intends to tackle its challenges in future developments.