For the past ten years, some of China’s biggest companies have divided the country’s tech industry. Now, they’re fighting proxy wars in the emerging markets of Southeast Asia and India, battling it out for a share of the regions’ digital real estate.

China’s tech giants are major players in India and Southeast Asia. They’ve had a hang in some of the regions’ biggest unicorns, including internet platform provider Sea Limited, e-commerce titan Lazada, food delivery giant Swiggy, and super app Gojek.

Expanding Empires

Expanding Empires is TechNode’s monthly data-driven newsletter looking at where and how Chinese tech majors are investing in up-and-comers around the world. Available to TechNode Squared members.

“These investments are building the muscles for a world-class clash of titans—with the big guys competing head to head and local players serving as proxies for the foreign giants,” consultancy Bain & Company said in a report describing the scramble for market share in Southeast Asia.

China’s tech giants are known as jealous backers. When Chinese startups take money from a tech major, they’re often committing to a side and its associated ecosystem. That’s why Tencent invested in Pinduoduo—the e-commerce company’s business model is based on users getting their Wechat contacts to buy items with them.

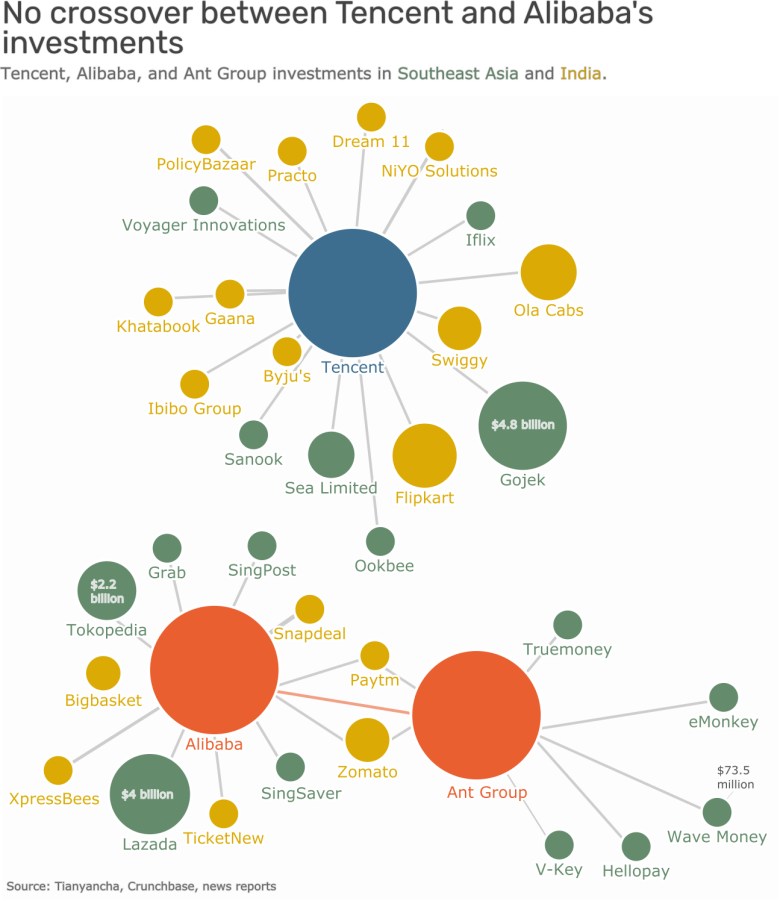

How much do these proxy wars spill over into Chinese tech giants’ new stomping grounds—Southeast Asia and India? I wanted to know, so over the past few weeks I’ve scraped, cross-referenced, and analyzed public data to map just how divided the digital landscape is in India and Southeast Asia. Here’s what I found:

- Chinese tech majors including Tencent, Alibaba, and Xiaomi have ploughed more than $26 billion into startups in the Southeast Asia and India regions.

- Very few of the startups have investment from the same Chinese tech giant, dividing the young companies into camps depending on where they received their funding.

- The battleground is predominantly focused on fintech and e-commerce.

- In Southeast Asia, Alibaba, Ant Group, and Tencent have made the biggest fintech investments. Meanwhile, Alibaba and Tencent lead in e-commerce funding in both Southeast Asia and India.

- Also, in India, Tencent, and Xiaomi have participated in rounds worth more than $2 billion to fund mobility companies.

In the past five years, companies including social media and gaming giant Tencent, e-commerce firm Alibaba and its fintech affiliate Ant Group, search company Baidu, and smartphone maker Xiaomi have participated in 89 funding rounds totalling nearly $26 billion for Indian and Southeast Asian startups.

Simultaneously, Chinese investment has shifted away from startups in the US to those in Southeast Asia and India as a result of rising US-China geopolitical tensions.

Funding round totals

Corporate giants jealously guard information about their investments in order to avoid tipping off their rivals. As a result, our data includes the total value of each funding round—a figure that includes contributions from other investors. While the data is incomplete, it still functions as a proxy for undisclosed numbers, and allows us to gauge Chinese tech giants’ stakes in various industries and regions.

Battle for fintech supremacy

Southeast Asia and India’s underbanked population are driving a fintech boom.

Underbanked people typically don’t have sufficient access to commercial banking services. But with the advent of digital wallets in the region, they’re able to hail a ride, buy online, and order food for delivery. The higher availability of these platforms then stimulates a need for more fintech services.

According to Bain & Company, digital payments in Southeast Asia have reached an “inflection point,” with transactions expected to reach $1 trillion by 2025.

Chinese tech majors don’t want to miss out. While Tencent and Alibaba operate their own digital payment platforms in several countries around Southeast Asia, the two companies have backed more than a dozen digital payment platforms in the region and India.

These companies collectively account for around 150 million users in Southeast Asia, according to a report by Dealstreetasia. Meanwhile, in India, that number reached more than 350 million in 2019.

Tencent and Alibaba are each recruiting their own team. No fintech startup in the two regions has been backed by both companies.

We don’t know exactly how much Alibaba and Ant invested into e-wallets—of these investments, most were either for undisclosed amounts or into large conglomerates whose e-wallets are not the whole show. The one disclosed e-wallet investment, into Myanmar’s Wave Money, was for $73.5 million.

Alibaba has backed companies that are focused solely on digital payments, including WaveMoney and Thailand-based Truemoney, as well as large conglomerates that offer payment services among others, including e-commerce giant Lazada and internet service platform Grab. In India, the two Chinese giants have invested in digital payments platform Paytm.

Tencent has taken a different approach. The company hasn’t invested in any e-wallet-first companies, but has taken stakes in several large firms that, like Wechat, offer wallets.

Tencent has taken parts in rounds for Southeast Asia and Indian companies that total $9.4 billion. These companies include Sea Limited, which operates Airpay and Shopeepay; Gojek and its Gopay system in Southeast Asia; as well as Swiggy Wallet and Ola Wallet in India.

Online services

E-wallets are being used for services ranging from ride-hailing to food delivery to e-commerce.

In Malaysia, the government is incentivizing use of digital payments by offering MYR 450 million ($108 million) initiative, giving MYR 30 to all Malaysians older than 18 who earn less than MYR 8,333 a month. The incentive can be claimed using a variety of e-wallets, including Grabpay.

Like the e-wallets, Chinese tech majors are divvying up these digital commerce platforms.

E-commerce is one major battleground. China’s tech giants have divided up their Southeast Asian counterparts. On the Tencent-affiliated side, we have Singapore-based Sea Limited—a behemoth covering e-commerce, payments, and gaming. On Alibaba’s side, we have Lazada, a Singapore headquartered e-commerce company the Chinese giant acquired in 2016 for $1 billion.

The same is true in India, where the two companies have bifurcated the country’s e-commerce and food delivery sectors. While Alibaba backed food delivery startup Zomato. Tencent funded Swiggy. While Alibaba backed Bigbasket, Tencent funded Flipkart.

Earlier this year, Zomato was reportedly in talks with Bigbasket to offer groceries on its food delivery platform. Both companies are backed by Alibaba.

Tencent and Alibaba have participated in rounds for e-commerce companies in the region worth a total of $12.8 billion. This total includes some investments we have already counted above as digital payments digital payments.

Meanwhile, Chinese lifestyle services giant Tencent-backed Meituan, a far less active international investor than either Alibaba and Tencent, has also backed Swiggy.

Chinese tech firms are not only competing among each other, but also with their US counterparts, including Amazon, Facebook, and Google.

Ride-hailing boom

With a combined urban population of around 800 million people, getting people from one place to another has become ever more important. Ride-hailing platforms have stepped in to fill this gap.

Several Chinese tech firms have funded mobility startups in Southeast Asia and India, but there is less of a clear cut divide. Southeast Asia’s two biggest mobility companies, Grab and Gojek, compete head-to-head in Indonesia, Vietnam, Singapore, and Thailand. These two firms also offer a host of other services, including food delivery and payments.

What happens when new giants with connections to Tencent and Alibaba enter the field? Well, it depends: Meituan, backed by Tencent, has joined the older company in backing Gojek and Swiggy.

Didi is a boundary-crosser—it was formed by a merger between Tencent- and Alibaba-backed ride-hailing firms—but has integrated with the Tencent ecosystem. However, it joined with Alibaba to back Grab.

Gojek has raised $4.8 billion from funding rounds in which Tencent and Meituan took part, while details of Alibaba’s 2018 investment in Grab were not disclosed. Now, Alibaba is reportedly looking to invest $3 billion in the Southeast Asian mobility firm. Chinese ride-hailing giant Didi took part in two of Grab’s funding rounds, worth $2.9 billion.

In India, Xiaomi and Tencent are dividing up the country’s ride-hailing market. In 2017, Tencent invested in Ola Cabs as part of a $2 billion funding round. Then, earlier this year, Xiaomi backed Oye! Rickshaw—a company that provides last-mile electric rickshaw rides—as part of the company’s $10 million Series A.

Chinese companies may have a harder time investing in India startups in the future. Indian officials this year launched an offensive banning more than 100 apps operated by Chinese companies and increasing scrutiny of investments from neighboring countries.

What’s next

For China’s tech giants, Southeast Asia is an important market, and they’re in it for the long haul. Several companies have announced plans to bolster their presence in the region over the next new months.

Tencent said in September that it had opened a new office in Singapore in an effort to boost its business in the region. Meanwhile, Bytedance reportedly plans to invest billions of dollars and recruit hundreds of employees in Singapore in the next few years. A source told CNBC that Bytedance had already begun moving engineers to the city, with previous reports claim the company aims to set up a data center to back up US data.

The investment war between China’s biggest tech firms will likely only intensify as companies double down on the region’s burgeoning digital economy. But they won’t just be competing among each other.

US tech giants are shown interest in investing in the same companies Alibaba and Tencent already have stakes. In 2018, Microsoft invested in Grab. Meanwhile, Amazon may be zeroing in on Gojek and Google is reportedly taking part in a $350 round for Indonesian e-commerce firm Tokopedia—one of Alibaba’s portfolio companies.

The future battle for Southeast Asia may not be between Chinese tech giants, but US companies and their Chinese counterparts.