What do the global empires of China’s tech giants look like? I began asking myself this question months before starting Expanding Empires, a reporting effort to map out the global tech investment footprint of China’s biggest investors. Now, we’re bringing it to an end.

Over the past six months, I’ve scraped, analyzed, and visualized data to provide a better picture of where China’s biggest tech companies are investing, how the geopolitical climate has led to dramatic shifts in their focus, and where they might be headed next.

China’s tech giants have a massive overseas presence. While you might not see their logos on the apps and digital services you use everyday, they have backed some of the world’s biggest tech firms.

The answer to my initial inquiry, it turns out, is complicated.

How Chinese companies like Alibaba, Tencent, Meituan, and Xiaomi approach their burgeoning empires abroad is as varied as the countries in which they invest.

Expanding Empires

After half a year of exploring Chinese tech companies’ investments abroad, Expanding Empires’ time has come to an end. But we aren’t downsizing our coverage of China tech: we’re already preparing to launch a new newsletter for TechNode members. Keep an eye open for details.

Funding rounds in which Chinese tech companies have participated—or in numerous cases, lead—have created some of the world’s biggest tech giants. In the US, these include mobility companies Uber, Tesla, and Lyft; in India, Paytm, Flipkart, and Bigbasket; and in Southeast Asia, e-commerce giants Lazada and Sea Limited.

For the final edition of Expanding Empires, we look back at where overseas China tech investment started, how things have changed, and where it’s going. While each company has its own trajectory, there are some broad trends that appear to be defining China’s involvement in the global tech industry.

The early days

It all started in the US. In 2008, just months before the housing bubble burst, before Lehman Brothers collapsed, before the global economy plummeted into a deep recession, Tencent bet on a little-known gaming studio in San Francisco.

An $11 million investment in Outspark set the tone for Tencent’s rapid expansion abroad. The Chinese company would soon become the biggest gaming firm in the world. But more importantly, the investment marked the beginning of China’s scramble for a foothold in the US tech industry.

By 2015, seven years after Tencent’s first US investment, Chinese tech giants including Tencent, Alibaba, Baidu, and Xiaomi had taken part in nearly 40 funding rounds worth a combined $2.4 billion for US companies.

China’s investment footprint in the US was largely driven by Tencent and Alibaba, and some of the funding rounds in which these companies took part were massive. In 2016, Alibaba participated in a $1 billion round for mobility firm Lyft. Two years later, Tencent took part in a $9 billion round for Uber.

The list of big ticket names goes on: Tencent invested in Tesla, Reddit, and Universal Music Group. Alibaba plowed money in Magic Leap, Snap, and participated in several rounds for Lyft.

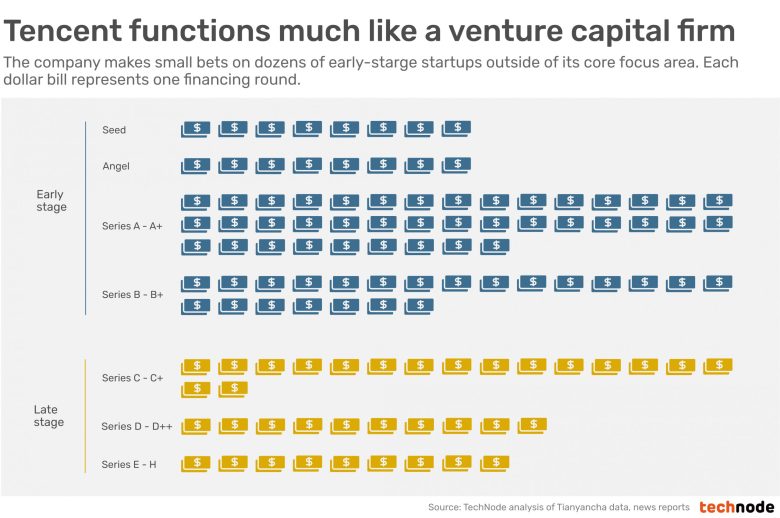

Tencent is unique among its Chinese counterparts—it’s far more global. The company has funded more than 140 companies outside China—double that of Alibaba. Many of these were early-stage investments.

2015 to 2017 marked a spring in Chinese tech investment in the US. By the end of 2017, Chinese companies had taken part in more than 100 rounds for US companies, totalling more than $9 billion.

But by 2018, that had all begun to change.

READ MORE:

66 startups: How Alibaba spends billions on global investments

From funded to funder: how Tencent places its VC bets

The great switcheroo

Chinese tech companies’ investments appeared to be paying off. Valuations of companies they had invested in soared. They were participating in funding rounds with unprecedented frequency.

In 2016, Alibaba, Tencent, and Baidu took part in 20 rounds for US companies. But by 2019, that had fallen to a meagre three.

What had happened? One reason is the allure of Asia’s developing markets. But another is politics.

The Trump administration had become increasingly critical of China, and began pushing back against some of the country’s biggest tech companies. Chinese telecommunications giants ZTE and Huawei quickly fell victim to US scrutiny. Washington’s offensive nearly killed ZTE after the company was found to have violated American sanctions against Iran and North Korea.

But the scrutiny also extended to foreign investments in the US—particularly those that came from China.

In late 2018, the US changed its foreign investment rules and began scrutinizing deals for non-controlling stakes in US firms. Previously, investment reviews only took place when a foreign firm took a majority stake in a US company.

The changes were directed firmly at Chinese companies, as lawmakers feared their investments were abetting tech transfers from the US to China.

The US-China Investment Project estimates that Chinese venture funding in the US totaled $400 million in the first quarter of 2020, down from $640 million during the same period in 2019, and $1 billion in 2018. A global pandemic beginning in China also contributed to this fall.

The resulting dropoff in investment was “distinctively Chinese,” according to a report by the US-China Investment Project. Despite the decrease in Chinese investment, overall funding of US startups largely remained the same.

Driven away from the US by increased regulation and attracted by the potential of big returns from developing markets, China tech quickly turned to the other side of the Pacific, honing in on South and Southeast Asia.

READ MORE:

Before the bans, China tech investment turned away from US

Alibaba had seen potential for growth in Southeast Asia and India for years. In 2016, the company bought Southeast Asia’s biggest e-commerce company: Singapore-headquartered Lazada.

The deal was Alibaba’s biggest overseas investment. It followed up a year later with another $1 billion investment, upping its stake from 51% to 83%. Then, in 2018, it plowed in another $2 billion.

The move to Southeast Asia coincided with its pull back from America. Between 2010 and 2015 Alibaba participated in 17 US-based rounds. But since 2018, that number dropped to five. During the same period, Alibaba has taken part in 19 rounds in India and eight in Southeast Asia.

Tencent made similar moves, though the majority of its investments are in the US. The company first invested in Southeast Asia in 2016, when it participated in a round for internet platform provider Sea Limited for an undisclosed amount. It followed up with an additional $1.4 billion round in 2019. Sea runs some of the region’s biggest online platforms including e-commerce service Shoppee and gaming platform Garena.

Tech investment proxy wars

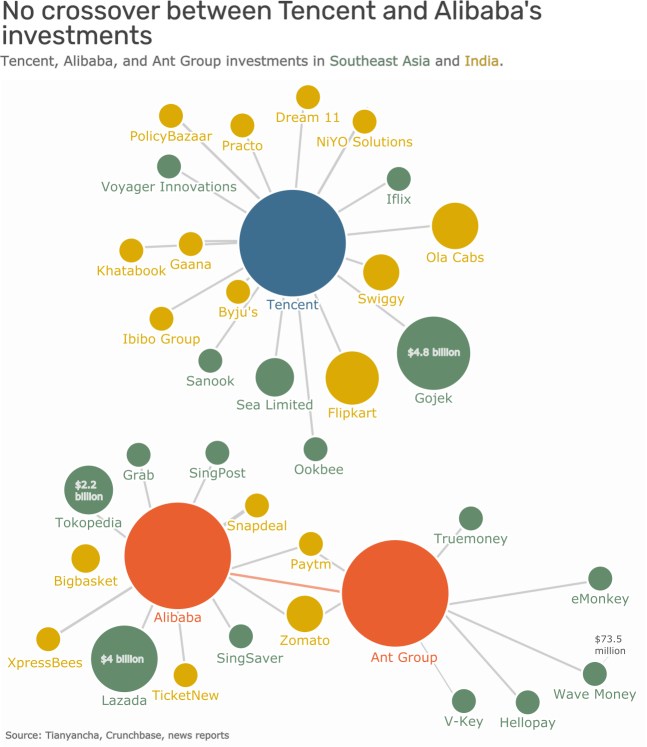

Since then, Tencent and Alibaba have divided up Southeast Asia and India. The battle between these two companies—as well as Xiaomi—is focused on fintech and e-commerce.

Despite Alibaba and Tencent operating their own digital payment platforms in several countries across Southeast Asia, the two companies have backed more than a dozen e-wallets in the region and India—and no one startup is backed by both.

Alibaba and Tencent have taken different approaches when backing e-wallets. While Alibaba backs a mix of conglomerates that run e-wallets as part of a wider business, as well as fintech-first companies, Tencent has only backed the conglomerates.

In Southeast Asia, on the side of Alibaba and its fintech affiliate Ant Group are Myanmar’s Wave Money, Thailand’s Truemoney, as well as Lazada and internet service platform Grab, which run e-wallets as part of their business. In India, the two Chinese companies have funded Paytm.

Meanwhile, Tencent has backed Sea Limited, which operates Airpay and Shopeepay; Gojek and its Gopay system in Southeast Asia; as well as Swiggy Wallet and Ola Wallet in India.

But it’s not just fintech. For Chinese companies, the stakes for tech investment are high in India and Southeast Asia at large.

“These investments are building the muscles for a world-class clash of titans—with the big guys competing head to head and local players serving as proxies for the foreign giants,” consultancy Bain & Company said in a report describing the scramble for market share in the region.

READ MORE:

Chinese tech giants have tens of billions at stake in India

Proxy war? Alibaba, Tencent draw lines across Southeast Asian unicorn scene

Untapped markets

While the US has made it more difficult for Chinese companies to invest and competition in Southeast Asia heats up, another market has caught the attention of China’s tech companies: Africa.

Home to 1.3 billion people and six of the world’s ten fastest growing economies, the continent has a thriving tech scene. Firms like Huawei and ZTE have a long history in Africa. Roughtly 70% of all 4G base stations on the continent are made by Huawei.

But as connectivity across the continent improves, other Chinese companies have seen opportunities in providing—and backing—digital services.

Tencent, gaming giant Netease, Meituan, and smartphone maker Transsion have already bet on African companies. Meanwhile, Alibaba has taken a different approach by launching training programs for aspiring African entrepreneurs.

Their presence on the continent is still modest, but has grown steadily since 2018, with 2019 seeing record amounts of Chinese involvement in Africa’s tech sector.

“Africa is often still a greenfields continent where Chinese companies have a more equal or better chance to compete,” Africa Analysis’ Dobek Pater told the South China Morning Post last year.

Transsion, which controls around 40% of the continent’s smartphone market, has started delving into digital services in Africa. In 2015, the company launched music streaming service Boomplay through a joint venture with Netease. Primarily focused on the African market, 85% of its users come from Nigeria, Ghana, Kenya, and Tanzania.

Startups in Africa raised a total of $2 billion in 2019, according to data from global investment firm Partech. While a small percentage of the total came from China, Africa has seen an increase in attention from Chinese investors.

Chinese-owned, Norway-based software company Opera in 2017 pledged to invest $100 million in Africa’s digital economy. The company later launched Opay, a super app that included payments and delivery services, in Nigeria.

Meanwhile, Africa-focused fintech platform Palmpay launched in Nigeria after receiving $40 million in investment from Transsion and Netease. The deal also meant that Palmpay would come pre-installed on 40 million on Transsion’s phones this year.

Ant Group, which runs one of China’s most popular payment platforms, has also taken notice. In 2019, the company partnered with Flutterwave, a Silicon Valley- and Lagos-based fintech company, adding Alipay as a payment method for Flutterwave’s 60,000 merchants. Ant has also partnered with South African mobile operator Vodacom to launch a payments app in the country.

READ MORE:

China tech in Africa: flip phones to fintech

From sanctions on Chinese companies in the US to uncertainty from app bans in India, Chinese tech investors have had a rough ride. But there have also been many successes. In some cases, the effects of their influence have been subtle, quietly backing startups worldwide. In others, like Alibaba’s takeover of Lazada, their funding has allowed them to take massive portions of a developing market.

So what’s next? One of the world’s largest continents. Only time will tell how the battles between these Chinese companies, as well as with their US counterparts, will play out.